Business Acumen X: Deficits

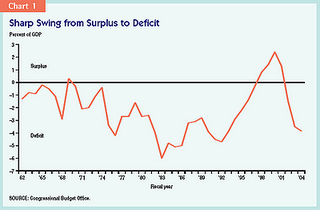

Among the most important economic concepts discussed regularly are the federal budget deficit and the US trade deficit. Many people do not have a clear basic grasp of these concepts, so here are some definitions ...The federal budget deficit is the amount by which federal government spending (including Social Security) exceeds receipts (mostly taxes, fees, and tariffs).

As with many accounting concepts, there is some wiggle room in how the deficit is computed. You can find a detailed explanation of the computation issues here.

It is important not to confuse the annual budget deficit with the national debt, which is the sum total of all annual deficits, less surpluses in the years when receipts exceeded outlays, since the federal government came into being over two centuries ago. If you want to know "The Debt To the Penny," you can go to this US Treasury site.

The trade deficit measures the dollar amount by which merchandise imports into the US exceed merchandise exports.

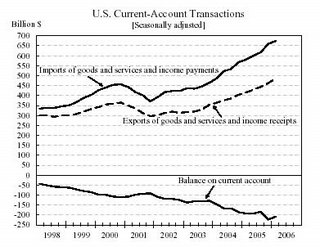

An important point to understand about the trade deficit is the narrowness of the imports and exports it covers. Countries trade not only merchandise, but also a range of services — transportation services, tourist services, business and professional services, and earnings on foreign investments net of payments to foreigners with investments in the US. In addition, residents of the US send funds overseas — transfers, gifts, and donations — for which nothing is received in return. The US current account deficit, graphed below, reflects receipts and payments associated with this broader group of international flows (goods, services, unilateral transfers).

Finally, investors buy and sell assets outside their home countries, which also affects the overall balance of payments.

In sum, any analysis of the strength of the US in the global economy must look beyond the balance of trade to all categories in which we do business internationally. The current account balance is generally viewed as the most significant measure because it reflects whether the US is a net creditor to the rest of the world (current account surplus) or a net debtor (current account deficit).

Labels: Business acumen

<< Home